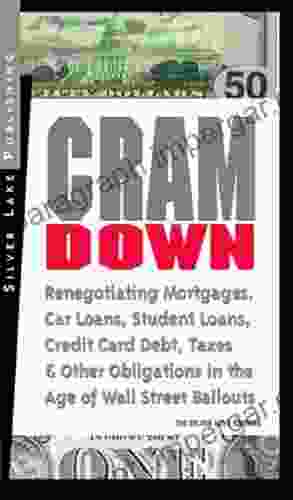

Renegotiate Your Financial Burden: Essential Guide to Debt Relief

Uncover the Secrets of Renegotiating Your Mortgages, Car Loans, Student Loans, Credit Card Debt, and Taxes

In the face of overwhelming financial obligations, it's easy to feel lost and desperate. But there is hope. Renegotiating your debt can provide much-needed relief and put you back on track to financial stability.

5 out of 5

| Language | : | English |

| File size | : | 377 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 142 pages |

| Lending | : | Enabled |

This comprehensive guide will empower you with the knowledge and strategies to successfully renegotiate your mortgages, car loans, student loans, credit card debt, and even taxes. By following the expert advice provided here, you can reduce your monthly payments, lower your interest rates, and potentially eliminate your debt altogether.

Understanding the Mechanics of Debt Renegotiation

Before embarking on the journey of debt renegotiation, it's crucial to understand the fundamental principles involved.

1. Know Your Rights

Familiarize yourself with the laws and regulations that protect borrowers. This knowledge will arm you with confidence and give you a stronger negotiating position.

2. Gather Your Financial Documents

Prepare a comprehensive financial snapshot that includes your income, expenses, assets, and liabilities. This information will help you determine your negotiating leverage.

3. Contact Your Lenders and Creditors

Initiate communication with your lenders and creditors as soon as you realize you're struggling to meet your payments. Be honest and transparent about your financial situation.

4. Be Prepared to Negotiate

Don't expect a quick and easy solution. Renegotiating debt requires patience, persistence, and a willingness to compromise.

Renegotiating Mortgages: Relief for Homeowners

Mortgage renegotiation can help homeowners who are facing foreclosure or struggling to make their monthly payments. Here's how to approach this process effectively:

1. Explore Government-Backed Programs

FHA, VA, and USDA loans offer programs specifically designed to assist homeowners in financial distress. These programs may allow you to reduce your interest rate, extend your loan term, or even receive a loan modification.

2. Contact Your Lender

Reach out to your mortgage lender and explain your situation. Be prepared to provide financial documentation and demonstrate your willingness to negotiate.

3. Consider a Loan Modification

A loan modification can permanently alter the terms of your mortgage, resulting in lower payments and reduced interest rates. This option is typically available to homeowners who have a valid reason for their financial hardship, such as a job loss or medical emergency.

Car Loan Renegotiation: Options for Drivers

If you're falling behind on your car payments, renegotiating your loan can prevent repossession and improve your credit score.

1. Contact Your Lender

Discuss your financial situation with your lender and explore possible options. You may be able to obtain a loan extension, reduce your interest rate, or make smaller payments.

2. Consider Refinancing

Refinancing your car loan with a lower interest rate can significantly reduce your monthly payments. However, this option may not be available if your credit score has declined.

3. Explore Debt Consolidation

Debt consolidation involves combining multiple debts, including your car loan, into a single, lower-interest loan. This strategy can simplify your finances and potentially save you money.

Student Loan Renegotiation: Relief for Higher Education

Student loans can be a significant burden, but there are options for renegotiation that can ease your financial strain.

1. Federal Student Loan Programs

The federal government offers several programs that allow you to adjust your student loan repayment plan, such as income-driven repayment and loan forgiveness programs.

2. Private Student Loan Renegotiation

Renegotiating private student loans can be more challenging, but it's not impossible. Contact your lender and explain your situation. You may be able to secure a lower interest rate or an extended repayment period.

3. Explore Refinancing

Refinancing your student loans can help you save money by reducing your interest rate. However, this option may not be available to everyone, especially those with poor credit scores.

Credit Card Debt Renegotiation: Getting Out of the Revolving Door

Credit card debt can spiral out of control quickly. Here's how to renegotiate your way out of this financial trap:

1. Debt Consolidation

Consolidating your credit card debt into a single, lower-interest loan can significantly reduce your monthly payments. This option is ideal for those with good credit scores.

2. Balance Transfer

Transfer your credit card balances to a card with a lower interest rate or a 0% introductory APR. This strategy can help you pay down your debt faster and save on interest charges.

3. Negotiate with Creditors

Contact your credit card companies and explain your financial hardship. You may be able to negotiate a lower interest rate, a payment extension, or even a debt settlement.

Tax Debt Renegotiation: Dealing with the IRS

Tax debt is a serious matter, but there are options for negotiating with the IRS.

1. Installment Agreement

An installment agreement allows you to pay off your tax debt over a period of time. This option is typically available if you owe less than $50,000.

2. Offer in Compromise

If you're unable to pay off your tax debt in full, you may be able to negotiate an offer in compromise. This option allows you to settle your debt for less than the full amount owed.

3. Seek Professional Help

Tax debt can be complex. Consider consulting with a tax professional or tax attorney to help you negotiate with the IRS and explore your options.

Renegotiating your debt is not a sign of failure; it's a proactive approach to regaining financial control. By understanding your rights, gathering your financial information, and following the strategies outlined in this guide, you can successfully renegotiate your mortgages, car loans, student loans, credit card debt, and taxes. Remember, there is hope and help available. Don't give up on your financial well-being. Take action today and reclaim your financial future.

5 out of 5

| Language | : | English |

| File size | : | 377 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 142 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Jennifer Mandel

Jennifer Mandel Jennifer Moorcroft

Jennifer Moorcroft Jennifer Mckay

Jennifer Mckay Joan Chodorow

Joan Chodorow Jennifer E Brooks

Jennifer E Brooks Joanna Penn

Joanna Penn Jody Mitic

Jody Mitic Jessie Daniels

Jessie Daniels Jerry Nickle

Jerry Nickle Jeffery D Nokes

Jeffery D Nokes John Briggs

John Briggs Jill Hill

Jill Hill Joey Maddox

Joey Maddox John Burford

John Burford Joe Nobody

Joe Nobody Jody Thomas

Jody Thomas Jessi Baker

Jessi Baker Jim Forest

Jim Forest Jo Ann Reteguiz

Jo Ann Reteguiz Jenny Eaton Dyer

Jenny Eaton Dyer

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Chuck MitchellUnveiling the Communist Horizon: Pocket Communism, A Guide to Revolutionizing...

Chuck MitchellUnveiling the Communist Horizon: Pocket Communism, A Guide to Revolutionizing...

Jesus MitchellPollutant Discharge and Water Quality in Urbanization: A Comprehensive Guide...

Jesus MitchellPollutant Discharge and Water Quality in Urbanization: A Comprehensive Guide...

Xavier BellState Should Improve Accountability Over Funding, USAID Should Assess Whether...

Xavier BellState Should Improve Accountability Over Funding, USAID Should Assess Whether... Glenn HayesFollow ·3.4k

Glenn HayesFollow ·3.4k Emanuel BellFollow ·2.4k

Emanuel BellFollow ·2.4k Michael CrichtonFollow ·7.6k

Michael CrichtonFollow ·7.6k Oscar BellFollow ·15.5k

Oscar BellFollow ·15.5k Tom ClancyFollow ·10.2k

Tom ClancyFollow ·10.2k Marvin HayesFollow ·2.8k

Marvin HayesFollow ·2.8k Jake PowellFollow ·12.6k

Jake PowellFollow ·12.6k Virginia WoolfFollow ·17.5k

Virginia WoolfFollow ·17.5k

Christian Barnes

Christian BarnesUnleash Your Creativity: Build Interlocking 3D Animal and...

Discover the Art of Paper...

Terry Bell

Terry BellUnveiling the Secrets of Winning: A Comprehensive Guide...

In the realm of chance and fortune, the...

Albert Camus

Albert Camus101 Things That You Should Do Before Leaving The House In...

Starting your day right is...

Anthony Burgess

Anthony BurgessForcing Move 2024 Volume: Unleash Your Inner Grandmaster

Embark on an extraordinary chess...

5 out of 5

| Language | : | English |

| File size | : | 377 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 142 pages |

| Lending | : | Enabled |